Waaree Renewable Share Price Target 2024, 2025, 2027, 2030,2040

If you think about which share will be best for investment in recent times then you should know about Waaree Renewable Share Price Target. Today in our blog we will explain the basic idea about Waaree Renewable Share Price Target 2024, 2025, 2027, 2030. We did the research and took advice from experts to make this blog about the company’s growth, performance, etc.

Waaree Renewable Share Price Target is a trading share in the share market. In this article, we will discuss about company’s financial growth, the business policy of the company, the shareholding pattern of the company, and the forecast share price yearly basis. We use expert data and analysis to give clear knowledge about the Waaree Renewable Share Price Target. This article may be helpful to those who want to invest in this share right now. Let’s have a look at Waaree Renewable Share Price Target 2024 to 2030.

Waaree Renewable Technologies Company work?

Waaree Renewable Technologies is a leading solar manufacturing company in India. The company selected a place for expanding its brunch depending upon the geographic importance and business facilitation. Waaree Renewable Technologies is one of India’s largest renewable energy sources with an installed capacity of 12 GW as of the year 2023. The company was established in the year 1989 and the headquarters is situated in Mumbai.

Overview Of Waaree Renewable Technologies Ltd Company

Waaree Renewable Company provides clean energy by setting up on-site solar projects (rooftop and ground-mounted) and off-site solar farms (open-access solar plants). Waaree Renewable Company established its plants in Chikhli, Surat, Tumb, and Nandigram in Gujarat. Waaree Renewable is one of the solar modules which serves approximately 500 customers all over India. The headquarters of the company is situated in Mumbai.

| Company Name | Waaree Renewable Technologies Ltd |

| Established | In 1989 |

| Market Cap | ₹15,999.59 Crore |

| Book Value | ₹28.90 |

| Face Value | ₹2 |

| P/B | 77.88 |

| 52 Week High | ₹3,058.63 |

| 52 Week Low | ₹226.32 |

Waaree Renewable Technologies known as Sangam Renewables Limited and the company successfully installed 10,000 solar projects with a total executed power is 1,215 MW. The company produces electricity through different new technologies such as floating solar panels, solar rooftops, ground mounts, etc. The company completed 12 rooftop stations with high-quality productivity. The company is a subsidiary of Waaree Group. The company’s main work is to reduce Carbon footprints for reducing environmental pollution.

Financial Data Analysis Of Waaree Renewable Company

Before investing any share anyone wants to see the company’s performance, overall profit, and net sales amount. We need a basic idea about the company’s PE ratio, return on assets, current ratio, and return on equity. In the section below, we discuss the performance of the company. Waaree Renewable Share Price Target also depended upon the ratio which is described below.

PE Ratio (Price To Earning Ratio)

PE Ratio is calculated by Market price per share Earning price per share. It means the number of times an investor is ready to pay as compared to earnings time. Waaree Renewable Company has a PE ratio of 92.80, which is overvalued.

Return on Assets (ROA)

ROA is calculated by Profit After tax ÷ Total Assets. ROA is influenced by 2 factors return on sales and asset turnover. Waaree Renewable Company has a ROA of 31.85%, which is a good sign for the company’s growth.

Current Ratio

The current Ratio is calculated by Current Assets ÷ Current Liabilities. Waaree Renewable Company has a current ratio of 1.17.

Return On Equity (ROE)

ROE is measured by = Net profit ÷ Average Share holding equity. Waaree Renewable Company has an ROE of 72.99%, which is high.

Also Read- Suzlon Energy Ltd (SUZLON) Share Price Target

Waaree Renewable Share Price Target 2024, 2025, 2027, 2030

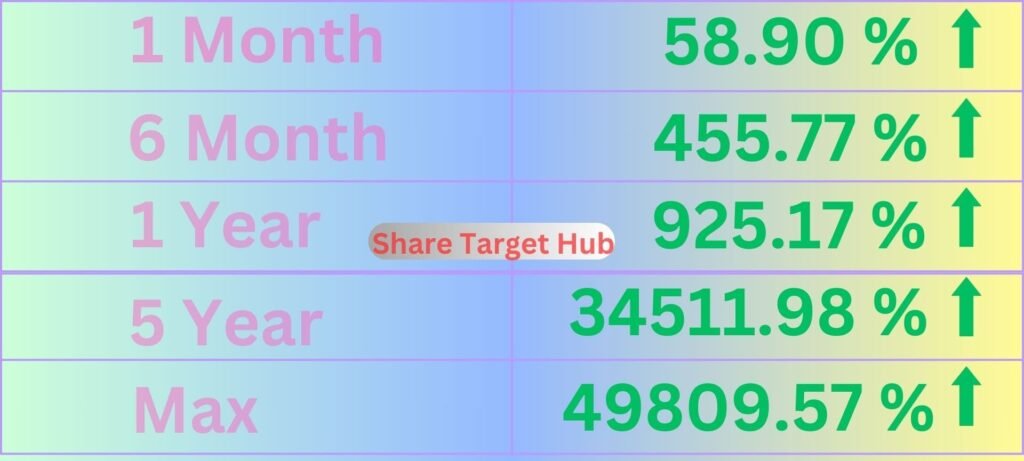

Waaree Renewable Share Price Target is a bullish trend in the share market. Waaree Renewable Share is under BSE (Bombay Stock Exchange). Before 6 months the share price growth was +1,809.29 (648.00%), the last 1-month share price growth declined to -410.70 (-16.43%), the last 1-year share price growth was +1,921.75 (1,152.47%), maximum share growth was +2,085.68 (73,960.28%).

Being a solar developer company will grow more in the future. Waaree Renewable Share Price always runs to big profit. The share always gives good returns to investors. The last 1 year’s share price return was 282.14% and the last 3 year’s share price return was 127.11%. Waaree Renewable share always gives good returns to investors. If anyone wants to invest in the share it will be beneficial in the long-term basis.

Waaree Renewable Share Price Target 2024

Waaree Renewable Technologies Ltd company mainly manufactures PV solar models, batteries, etc. Solar Models also include rooftop solar, ground-mounted solar, capex models, floating solar, renewable energy service company (RESCO) models, and work for proper maintenance of the equipment. The floating solar Model uses water bodies like ponds, lakes, and reservoirs for the installation of solar panels. In renewable energy service company models the company undertakes all aspects of rooftop solar project development.

| Year | Waaree Renewable Share Price Target 2024 |

| 1st Price Target | 1,452.66 |

| 2nd Price Target | 1,685.32 |

The revenue growth of the company increasing, yearly basis revenue growth is 337.15%. In the quarter three result for the year, the revenue amount is ₹323.45 Crore which was ₹74.23 Crore in the quarter three result of the financial year 2024. The annual revenue growth is over ₹500 Crore based on 31st March 2023. The EBITDA growth every year is 145.23% which stands for the company’s growth. If we look at the share price forecast of Waaree Renewable Share Price Target 2024, the 1st Price Target is ₹1,452.66 and the 2nd Price Target is ₹1,685.32.

Waaree Renewable Share Price Target 2025

Waaree Renewable Company completed 12 Stations of solar rooftops in the Mumbai Metro. The total rooftop solar power electricity installed capacity is 2.35 MW which is only 30% of the total power used in the Mumbai Metro Station. With the help of the Waaree Solar PV modules, the company provides electricity to all Metro Stations in Mumbai. Another one is the National Thermal Power Corporation (NTPC) which is situated in Gujrat, the first floating solar project with an installed capacity of 1MW grid.

| Year | Waaree Renewable Share Price Target 2025 |

| 1st Price Target | 1,723.74 |

| 2nd Price Target | 1,945.20 |

As the demand for renewable energy increases sales growth of the company also increases. The last 3 years sales growth was 458.12% and the last 1-year sales growth was 123.01%. The net sales amount was ₹154.12 Crore on March 2022 which became ₹342.12 Crore on March 2023. If we look at the share price forecast of Waaree Renewable Share Price Target 2025, the 1st Price Target is ₹1,723.74 and the 2nd Price Target is ₹1,945.20.

Waaree Renewable Share Price Target 2027

Another project in Solapur, Maharastra is a 21MWp ground-mounted solar project. From this plant, it is planned to generate 34500 MWh of power yearly. 64312 numbers of Waaree 325 wp solar modules are manufactured by this plant. The total supplied solar modules are 6GW and applied solar EPC projects are 1.1GW. The main target of the company is to provide sustainable energy with a cost-efficient process.

| Year | Waaree Renewable Share Price Target 2027 |

| 1st Price Target | 2,312.41 |

| 2nd Price Target | 2,585.96 |

The profit growth of the company also increases. The last 3 years’ profit growth was ₹586.23 Crore last 1 year’s profit growth was ₹192.23 Crore, last 5 years’ profit growth was ₹254.12 Crore. In the quarter three result of the year 2024, the net profit rate is ₹65.12 Crore which was ₹25.23 Crore in the quarter three result of the year 2024. PAT value of the company increased 251.23% in the September quarter of 2023. If we look at the share price forecast of Waaree Renewable Share Price Target 2027 the 1st Price Target is ₹2,312.41 and the 2nd Price Target is ₹2,585.96.

Also Read- Whirlpool Share Price Target

Waaree Renewable Share Price Target 2030

Waaree Renewable Company first introduced a solar project for Government entities, in Vietnam the company introduced the first International EPC project with an installed capacity of 50MW within a very short period of 100 days in the year 2018-20. One of the most important projects of the company in Vietnam Project which is made of International standards. Vietnam Power Plant is 48.9MW and has a generation capacity of 78,655 MWh of electricity per year.

| Year | Waaree Renewable Share Price Target 2030 |

| 1st Price Target | 3,412.23 |

| 2nd Price Target | 3,625.01 |

As the company is the oldest one and the demand for renewable sources the promoter holding capacity of the company is good which is 75% which means many good investors want to invest in the share. Total expenses growth was 93.23% in December 2023 which was -63.27% in December 2022.

To decrease carbon emissions Government of India also appreciate the company for more development. Indian Government also started many schemes for more development of the company. Not only the India Government many other countries’ governments also appreciate the company’s activities. All the share price forecasts depend upon the company’s overall performance, market-favorable conditions, etc. If anyone wants to invest it will be profitable in the long term basis. If we look at the share price forecast of Waaree Renewable Share Price Target 2030 the 1st Price Target is ₹3,412.23 and the 2nd Price Target is ₹3,625.01.

How To Purchase Waaree Renewable Share?

The most common trading platform for purchasing the Waaree Renewable Share is described below.

- Zerodha

- Upstox

- Groww

- Angelone

Peer’s Company Of Waaree Renewable

- Adani Green Energy

- Zodiac Energy

- Solex Energy

- Banka Bioloo

Investors Types And The Ratio Of Waaree Renewable Technologies Company

There are mainly three types of Investors in Waaree Renewable Technologies Company. The company’s growth also depended upon the ratio of investors who invested in the share.

Promoters Holding

Promoters Holding means how much capital is invested by company promoters (company owner) through overall capital. Waaree Renewable Technologies Company’s promoter holding capacity is 74.58%.

Public Holding

Public Investors are individuals who invest in the public market for profit in the future (large and small companies). Waaree Renewable Technologies Company’s public Holding capacity is 25.34%.

DII (Domestic Institutional Investors)

Domestic Institutional Investors (like Insurance, companies, and mutual funds) who invest in their own country. For Waaree Renewable Technologies Company’s DII is 0.08%.

Advantages and Disadvantages Of Waaree Renewable Share

Every share has some advantages and some disadvantages also. So, the Waaree Renewable Share Price Target also has some advantages and disadvantages which are described below.

Advantages

- The company shows a good profit in the last 3 years which was ₹586.23 Crore.

- The revenue growth of the company is 337.15% every year.

- The company has a small amount of debt and the interest cover ratio of the company is 69.12 which means all debt amounts will be cleared out.

- The company has an efficient cash conversation cycle which is 78.12 days which is a very good sign for the company’s growth.

- The ROE ratio of the company is 72.99% in the last financial year 2023 which is a very good sign for the company’s growth.

Disadvantage

The trending EBITDA is a high rate which is 145.23% every year which is a bad sign for the company’s growth.

Also Read- SJVN Share Price Target

FAQ

What is Waaree Renewable Share Price Target for the year 2024?

Waaree Renewable Share Price Target for the year 2024 is ₹1,920.85 to ₹2,920.23.

What is Waaree Renewable Share Price Target for the year 2025?

Waaree Renewable Share Price Target for the year 2025 is ₹1,723.74 to ₹1,945.20.

What is Waaree Renewable Share Price Target for the year 2026?

Waaree Renewable Share Price Target for the year 2026 is ₹2,025.36 to ₹2,245.02.

What is Waaree Renewable Share Price Target for the year 2027?

Waaree Renewable Share Price Target for the year 2027 is ₹2,312.41 to ₹2,589.96.

What is Waaree Renewable Share Price Target for the year 2028?

Waaree Renewable Share Price Target for the year 2028 is ₹2,612.20 to ₹2,845.02.

What is Waaree Renewable Share Price Target for the year 2030?

Waaree Renewable Share Price Target for the year 2030 is ₹3,412.23 to ₹3,625.01.

Who is the CEO of Waaree Renewable Technologies Company?

Mr. Vivek Srivastava is the CEO of Waaree Renewable Technologies Company.

Is Waaree Renewable Share good to buy?

Yes, the share growth of the company is good to the last 1-year share price growth was 1,152.47%, the last 6 months’ share growth was 1,809.29%, last 3 years’ profit growth was ₹586.23 Crore. The company will grow more in the future. If anyone wants to invest it will be profitable on a long-term basis.

What is the future of Waaree Renewable Technologies Company?

As the company is the producer of solar modules and installed green energy the demand of the company will increase more in the future. The annual revenue growth of the company is ₹500 Crore based on 31st March 2023. The annual profit growth of the company may reach above 193% which is very progressive rather to other companies.

What is the old name of Waaree Renewable Technologies Company?

The old name of Waaree Renewable Technologies was Sangam Renewables Limited which was changed in the year 2021, July.

What is the capacity of Waaree Renewable Company?

Waaree Renewable is one of the largest Solar PV Module manufacturers which can manufacture 12 GW in its plant in Gujarat.

Who is the owner of Waaree Renewable Company?

Mr. Hitesh Chimanlal Doshi is the owner of Waaree Renewable Company.

What Does Waaree Renewable Technologies company do?

Waaree Renewable Company produces Solar Modules for generating power and provides it to individual and commercial customers to reduce carbon emissions.

What is the turnover of Waaree Renewable Company?

In the financial year 2023, the turnover is ₹500 Crore of Waaree Renewable Company.

Conclusion

Hopefully, www.sharetargethub.com will help you gain some basic ideas about the Waaree Renewable Share Price Target. By doing the research and taking advice from expertise we ensure that on a long-term basis, Waaree Renewable Share Price Target may reach a very high position. Waaree Renewable Technologies Company is related to the solar model producers. So the demand for this sector also increases which helps the share to gain profit in the future.

If you think this website will be helpful for you then you can share it. If you have any questions please let us know through the comment box we will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.